Buying or Renting

By Edit Team | October 30, 2019 5:34 am SHARE

When one has to consider the option for buying or renting there are mainly three factors that need to be taken into account: cost of ownership, rental cost and intangible cost.

I t may sound like “To be or not to be” and at times this question can be that confusing! Today Indian infrastructure industry is poised for growth and there has been significant development in many areas including roads, railways, metro and urban transport projects. Nearly 9 per cent of our GDP is spent of Infra segment. Growth of infra, propels growth of other sectors so our government is giving huge momentum for development of infrastructure and construction service through focused policies like open FDI norms, large budget allocation, smart cities, housing for all etc.

The growth in infra will lead to growth in usage of construction machinery, material handling machinery and other sophisticated equipment. A lot of movement will be seen in equipment owning, selling, buying etc. The EPC companies, contractors and the end users will either buy or rent this equipment. The decision will be taken on the basis of various factors by these companies.

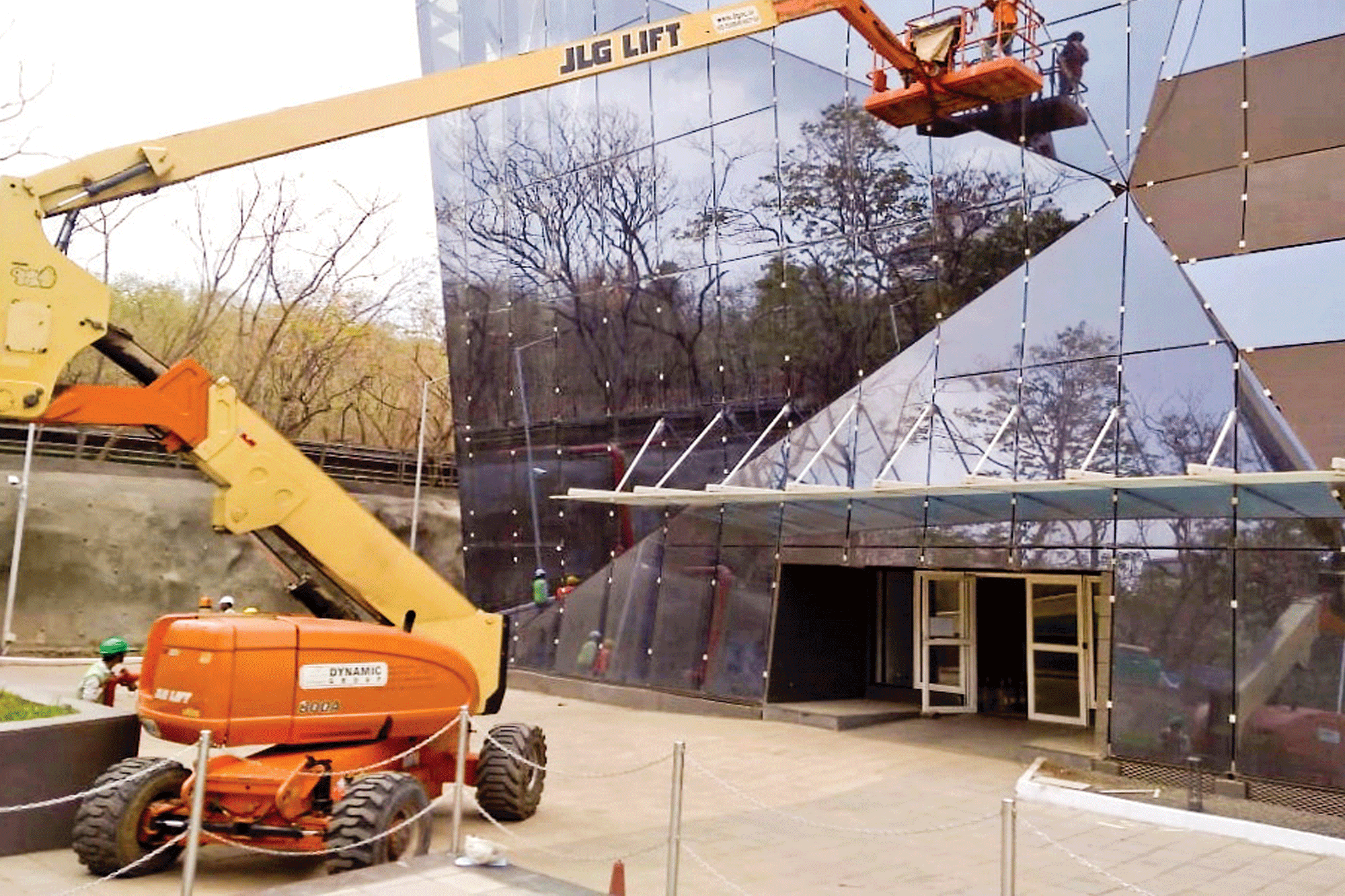

Generally, equipment or machineries rented is Mobile Cranes, Boom lifts & scissor lifts, D G Sets, Pumps, Light towers, Tunnel Boring machines, Telehandlers, Fork lifts, Dumpers, Dozers, Tippers, Pavers, Drilling machines etc. Plants and factories also find use of these equipment on continuous basis. They also Buy or Rent the equipment.

Factors influencing the decision of Buying or Renting

When one has to consider the option for buying or renting there are mainly three factors that need to be taken into account: cost of ownership, rental cost and intangible cost. Further, these three have sub factors.

Total Cost of Ownership: includes cost of capital, interest cost, depreciation cost, time cost (mainly manpower), insurance cost, maintenance cost, operation cost and real estate cost – place required to keep and maintain equipment.

Rental Cost: If machinery is rented, rental cost, time cost (mainly manpower)—timespent in procuring and time spent in making periodic payments

Intangible cost: Opportunity cost – the companies other than rental companies, if it blocks funds into the equipment, may lose future business opportunity. Also it may tend to look for work only related to equipment it has. Resource building – cost required to hire, retain and train the manpower to operate and maintain equipment.

Finally, decision of Rent or Buy depends on DNA of the company. It may be based on sound and strong policies, calculations or on the basis of the experience people have had in past. Many a times equipment are bought for some particular project and then they stay.

In short one has to think of:

- Inclination of management towards building Operation & Maintenance Competencies. Nature of projects handled. It will decide utilisation factor of equipment.

- Availability of Capex.

- Availability of real estate – For Keeping and maintaining the equipment.

When to sell the equipment

All the equipment has fixed life. During which cost is incurred in operating and maintain the same. People face this question and in absence of logical answer, they may decide to discard the equipment on the basis of emotions. For arriving at the decision of removing the equipment from fleet you should have enough data with you.

Following graph shows “Sweet Spot”, it is the point where one should plan for selling, discarding or removing the equipment from fleet.

Operating costs go on increasing, ownership cost come down. When operating cost surpass the benefit of reducing ownership cost you get a “Sweet Spot”. Beyond which there may be a period of limited use and then remove the equipment.

For more details contact:

Bharti Gokhale

Dynamic Crane Engineers Pvt. Ltd.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.