Electric construction machines to hit $126B market by 2044

By Staff Report | August 9, 2024 11:08 am SHARE

The construction machinery industry is fast evolving, with improvements in machine size and performance. IDTechEx’s analysis anticipates a market value of more than US$126 billion by 2044, emphasising this transformational shift.

The construction machine sector is still in the early phases of electrification, with the first tiny electric machine entering the market in 2015. However, IDTechEx’s new report, “Electric Vehicles in Construction 2024-2044: Technologies, Players, Forecasts,” demonstrates how today’s electric machines are larger and better than their counterparts from less than a decade ago. OEMs worldwide are accelerating the development of electric machines, and IDTechEx predicts that the market will be valued at more than US$126 billion by 2044.

Machine performance continues to increase

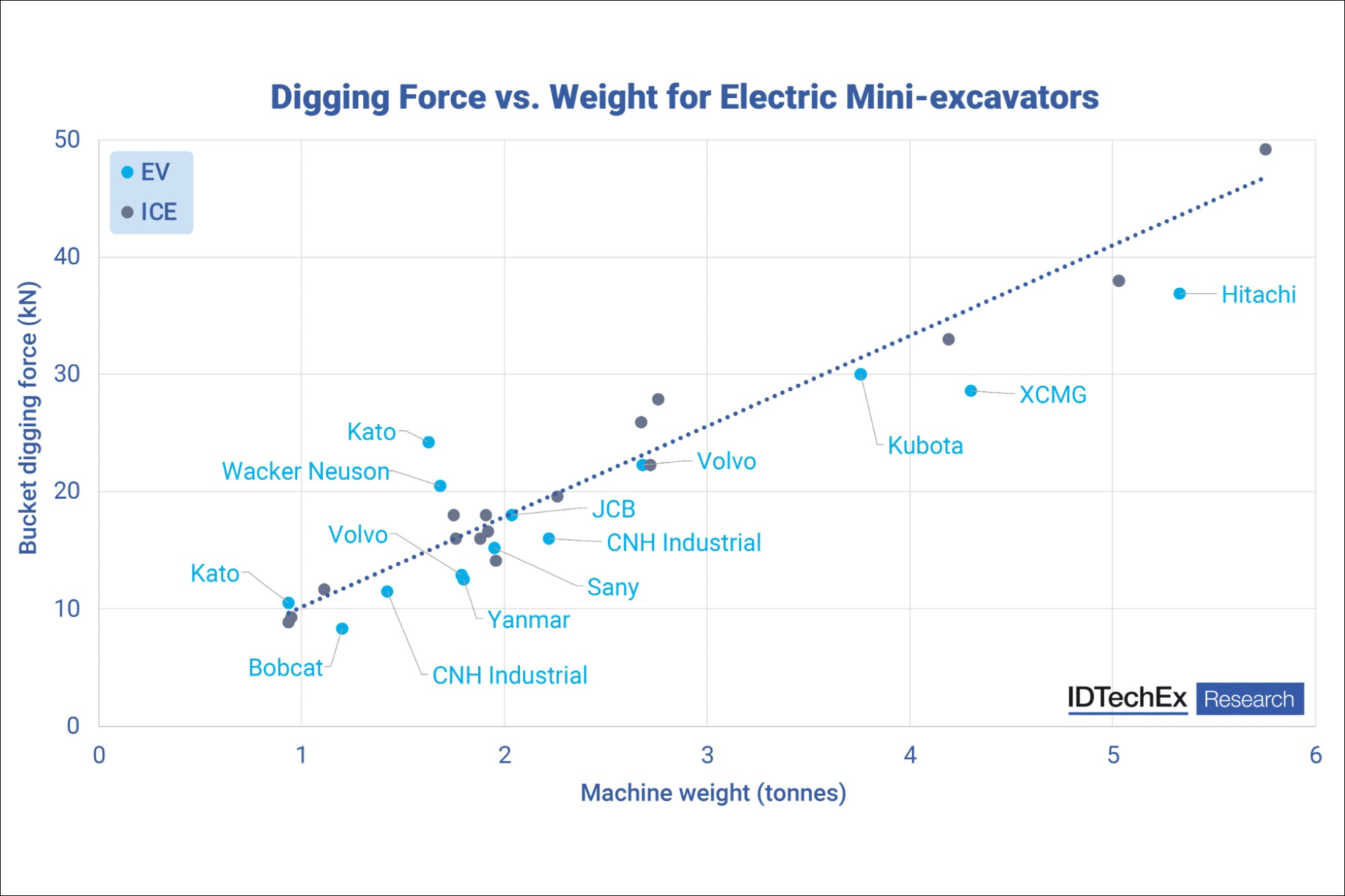

Mini excavators were the first electric machinery to appear on the scene. Their smaller sizes and lower workloads made them suitable trial grounds for construction electrification. Many construction businesses were concerned about whether these electric machines could survive the pressures of the job site while providing comparable performance to diesel engines.

According to IDTechEx’s latest assessment, electric mini-excavators have advanced to the point where they can compete with diesel in almost every significant measure. EVs provide comparable or even superior power than diesel machines, with models from Kato and Wacker Neuson capable of producing 30-60% more digging force than the average diesel machine of the same size. These machines’ runtimes have also improved significantly. Whereas the earliest machines on the market only lasted 4 to 6 hours on a single charge, current devices may operate for up to 8 hours (a full workday) as standard. Persistent battery development has played a significant role in this growth, and IDTechEx anticipates runtimes to reach 9 to 10 hours.

Large excavators and loaders are coming to the fore

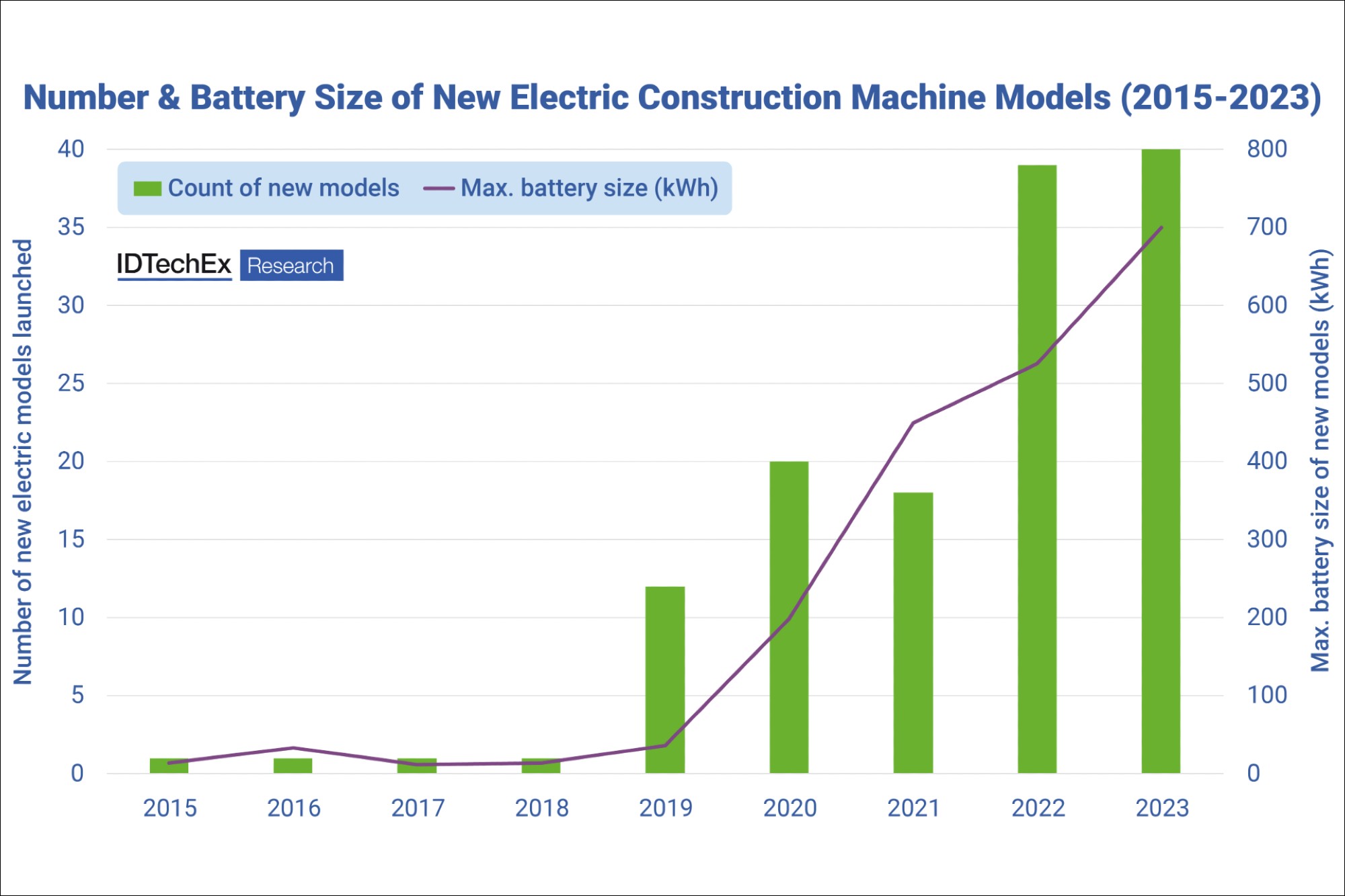

While mini-excavators dominated the early stages of electric construction machine growth and remained the market’s largest segment, development efforts have shifted to giant excavators and wheel loaders. These two machine types accounted for 35 percent of total equipment sales in 2023 and are among the most significant emitters of greenhouse gases on the job site, accounting for more than half of all construction machine emissions. Their electrification is thus critical to accelerating the decarbonisation of the worldwide construction industry.

As the number of new electric machine types entering production increased from 2019 to 2023, so did the size of these machines. Whereas 3-tonne mini-excavators were previously the pinnacle of electric machine technology, many OEMs today offer huge excavator models weighing 20 tonnes or more. In 2023, the Chinese OEM Know-How began building a 52-tonne electric excavator, the largest. Wheel loaders have reached a similar point, with new 20-tonne machines now the standard for electrification.

Larger machines require larger and more complex battery systems, and the rise of electric excavators and wheel loaders has resulted in a significant increase in battery sizes in construction over the previous five years. The maximum battery size installed in newly produced models has increased from ~30 kWh in 2018 (used in mini-excavators and similar tiny machines) to over 500 kWh by 2023. The Know-How 52-tonne excavator is outfitted with a massive 700 kWh battery, which IDTechEx says would cost $210,000 on its own and weigh more than 3.5 tonnes.

What’s next for EV construction machines?

Many of the larger machines that are now on the market have already followed in the footsteps of mini-excavators by matching the performance of diesel rivals. OEMs have reached the point where achieving performance parity is no longer a challenge, and they are focussing on expanding their EV portfolios to include larger machines and new equipment types. Chinese OEMs have been market leaders in this regard, manufacturing larger excavators and wheel loaders while also pioneering the electrification of mobile cranes weighing hundreds of tonnes.

Battery developments will play a significant role in defining the future of the electrical construction industry. OEMs are now charging far higher prices for batteries than the automobile sector, but increasing the scale of EV production and establishing dedicated supply chains will help to reduce costs. At the same time, increasing the efficiency of existing battery technologies and incorporating more modern Li-ion and future battery technologies will broaden the range of machines that can be electrified and improve their performance.

The new IDTechEx paper “Electric Vehicles in Construction 2024-2044: Technologies, Players, and Forecasts” delves deeper into the future of the electric construction machine industry. It predicts that the market will increase at a 21 percent CAGR to US$126 billion in value by 2044.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.