Indian CV sales expected to recover in H2FY25

By Edit Team | July 10, 2024 6:26 pm SHARE

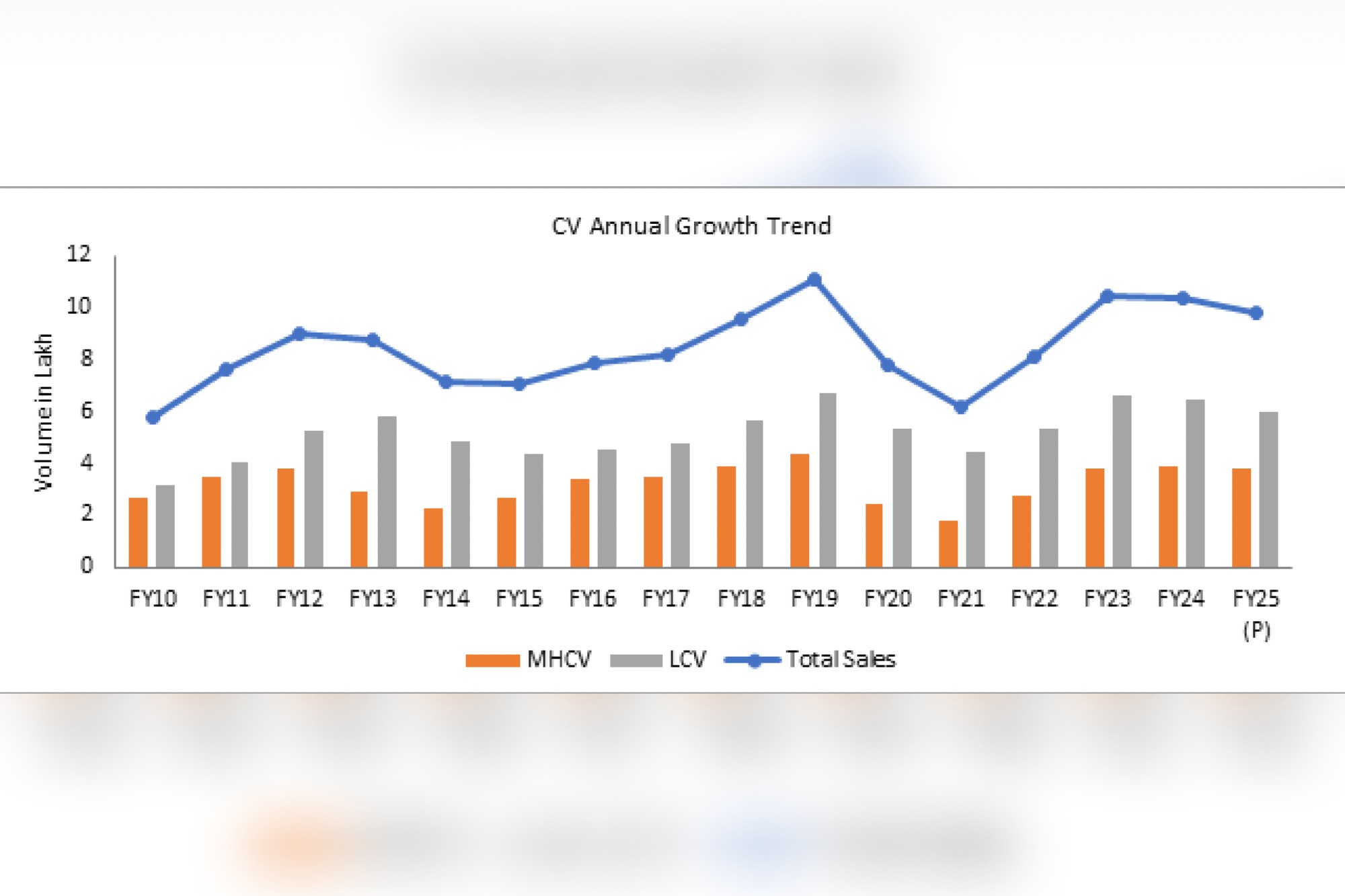

Indian CV sales are expected to decline by 3-6 percent in FY25 due to high inventory, increased costs, and election disruptions, with recovery anticipated in H2FY25 driven by infrastructure projects, interest rate drops, and electric CV adoption.

According to CareEdge Ratings, Commercial Vehicle (CV) sales volumes are expected to fall by 3-6 percent in FY25, owing to a slowdown in demand in both the Medium and Heavy Commercial Vehicle (MHCV) and Light Commercial Vehicle (LCV) segments, as well as high inventory levels at dealerships. The modest growth in FY24 was mostly due to the high base of FY23, the changeover to BS VI, which resulted in higher vehicle costs, and a halt in infrastructure projects during elections in the later part of the year, which resulted in heavier inventory with dealers.

According to CareEdge ratings, demand is expected to go up from Q2FY25, with the conclusion of general elections and an increase in infrastructure projects following the monsoon. Replacement demand and the mandated scrapping of older government cars drive sales in FY25. The CV industry is predicted to recover in H2FY25, owing to anticipated GDP growth, ongoing infrastructure projects, and potential interest rate reduction.

Arti Roy, Associate Director of CareEdge Ratings stated, “The commercial vehicle (CV) industry is expected to experience sluggish growth, with overall sales volume likely to decline by around 3-6 percent in FY25. Several factors contribute to this, including general election-related disruptions, elevated vehicle costs, and high channel inventory levels. However, there is hope for improvement in the latter half of FY25 as infrastructure projects pick up pace post-monsoon and anticipated interest rate cuts provide some relief”.

Hardik Shah, Director at CareEdge Ratings, says, “The Indian CV industry had witnessed its highest sales volume in FY19, and post-Covid, the industry was on track to surpass the same post significant improvement in sales volumes in FY22 & FY23. However, it faced a few hurdles in FY24 due to higher channel inventory, the impact of the transition to BS-VI norms, a rise in vehicle costs, and high interest rates. Looking ahead, the sales volume is expected to decline in FY25 before gathering pace in FY26”.

Slow and steady: CV expects comeback in H2FY25

The CV sector in India experienced significant year-on-year volume increases of roughly 30.7 percent and 28.7 percent, respectively. This boom was driven by pent-up demand as the economy recovered from the COVID-19 pandemic. MHCVs and LCVs performed critical roles in increasing overall commercial vehicle sales volume. Improved industrial and infrastructure demand fueled MHCV growth, while LCV was boosted by e-commerce’s continued expansion.

The CV sector encountered unforeseen obstacles in FY24, leading to a subdued volume growth of 0.7 percent. This was owing to declining pent-up demand in the home market, sluggish international demand, and higher vehicle costs as a result of the changeover to BS VI emission standards. The sector saw pre-buying in the March 2023 quarter ahead of the BS-VI emission rules, which boosted car prices by up to 5 percent beginning April 2023, resulting in weaker demand in H1FY24. Furthermore, sales in H2FY24 were hampered by a slowdown in the pace of infrastructure project implementation caused by the general election. Furthermore, sluggish rural demand remained since rural earnings did not keep up with rising car prices.

According to a report by CareEdge Ratings, when elections end and the monsoon season lessens by September-October 2024, the commercial vehicle (CV) market is expected to recover in the second half of FY25 (H2FY25). Expected interest rate reduction may give relief for vehicle financing. Replacement demand and the mandated scrapping of older government cars are likely to drive sales in FY25. However, despite these optimistic projections, the global CV industry is expected to contract by 3-6 percent in fiscal year 25.

Despite the overall issues in CV sales, MHCV and LCV show divergent trajectories in FY25. MHCVs are projected to improve in the second half of the fiscal year as infrastructure development continues following the monsoon. However, LCVs may suffer limits as a result of rising vehicle prices, high interest rates, and inflation, as individual or small local transport operators, who are the primary consumers of LCVs, may postpone fleet expansion plans due to their limited financial ability to absorb or pass on additional costs.

CV – electrifying its way

Despite its tiny fraction of total CV sales, the electric vehicle (EV) category grew significantly between FY21 and FY24. Key signs of this growth include rising adoption rates and market share, assisted by the progressive construction of EV infrastructure. Notably, the transition to EVs is most visible in the e-bus and light commercial vehicle (LCV) segments.

LCVs, such as delivery vans and small trucks, are converting to electric propulsion. Their importance in last-mile logistics makes them great candidates for electrification. The appeal of EVs stems from their lower operating costs (fuel and maintenance), which attract fleet operators.

Furthermore, e-buses have emerged as key drivers of EV adoption in the commercial vehicle (CV) sector. The desire for cleaner transportation choices fuels the market for e-buses, and government programmes help to accelerate the change.

A spike in demand for electric buses in India’s main cities is expected to drive CV growth. The rise in demand for electric buses in India can be attributed to various factors, including rapid urbanisation, which raises demand for sustainable and cleaner public transport systems, increased environmental concerns, large oil import bills from diesel-powered vehicles, technological advancements, and improvements in battery charging infrastructure. Furthermore, the Indian government, recognising the need for greener public transport, has launched several programmes to promote electric mobility. These include the FAME scheme (Faster Adoption and Manufacturing of Hybrid and Electric Vehicles) and the National Electric Mobility Mission Plan (NEMMP).

In FY24, registrations of electric heavy passenger vehicles (e-HPVs), notably huge electric buses, increased dramatically. Registrations climbed from 217 in FY21 to an astonishing 3,400 in FY24. During the same period, the number of electric light passenger vehicles (e-LPVs) registered increased from 360 to almost 10,500.

According to CareEdge Ratings, demand for electric buses is projected to stay strong in the future, thanks to a growing emphasis on cleaner transport systems and numerous government initiatives. Notably, last year, the government announced the PM e-bus Sewa Scheme, committing USD 2.4 billion to deploy and run 10,000 electric buses in 169 eligible cities using a public-private partnership model. These environmentally friendly vehicles will hit the road in 2024, with full deployment expected by 2026.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.