The future of power generation combines diesel, hybrid, and electric systems

By Staff Report | January 14, 2025 7:15 pm SHARE

In an exclusive interview with B2B Purchase, Gurunath Kulkarni, Vice President – Sales and Marketing at Baudouin, shares insights into the evolving landscape of DG sets in India. From addressing the latest technological advancements to discussing the challenges posed by market demands and renewable energy adoption, Kulkarni offers a comprehensive overview of the industry’s current and future trajectory.

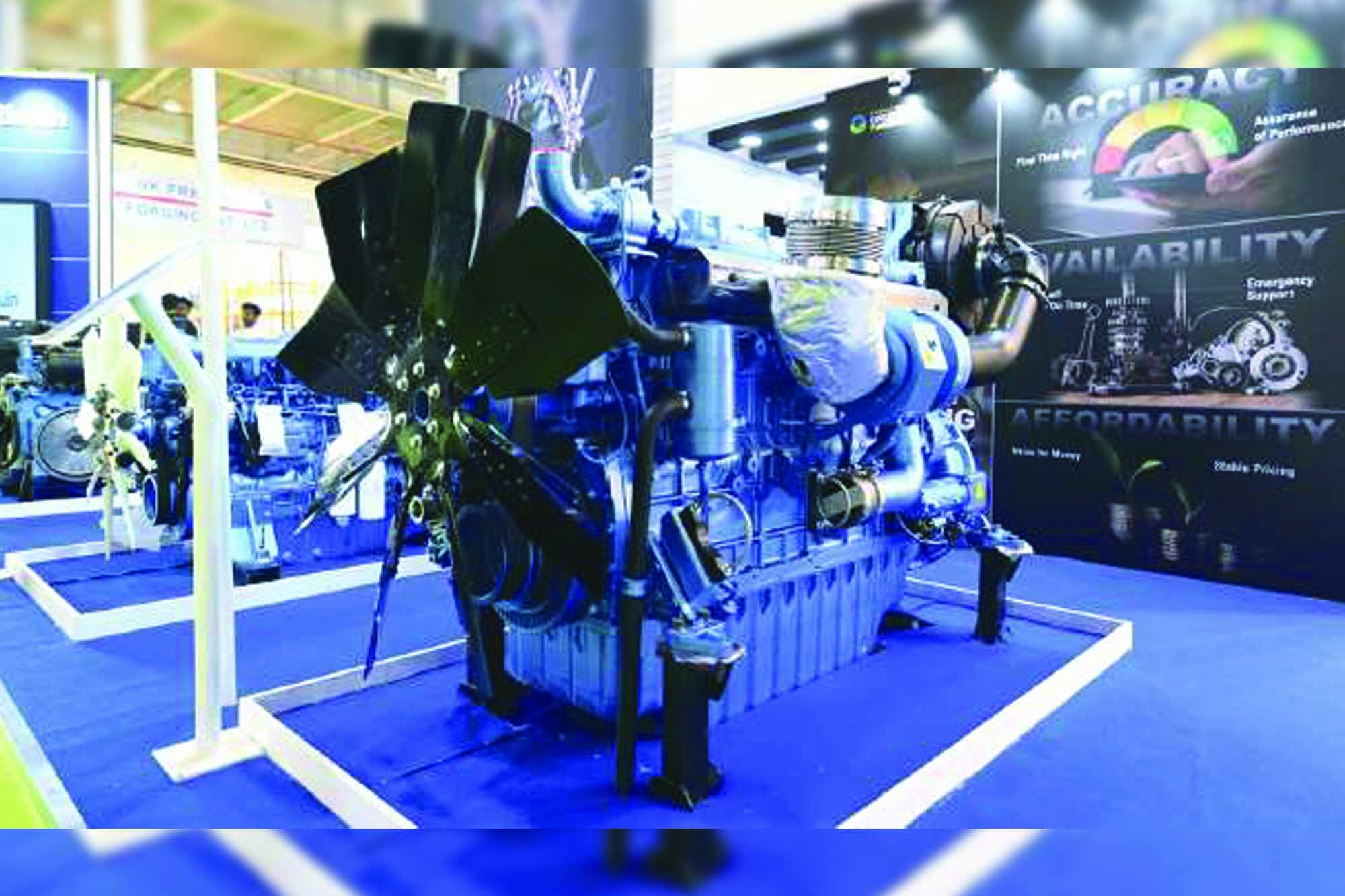

Could you tell us about the solutions Baudouin showcased at bauma ConExpo 2024?

We exhibited our entire selection of diesel generator (DG) sets that meet the most recent CPCB 4 Plus emission regulations. This covers units with a maximum power of 800 kW, a recently introduced product. We also showcased the 12M55, a medium to large engine. Despite not being the biggest engine, it is the most expensive model in our lineup. On the smaller side, we have showcased more compact engines than our other offers, even though they are not the smallest ones on the market. We are offering a broad selection that will help us grow our market share, which is currently between 15 and 16 percent.

Please elaborate on your products’ specific market needs, especially given the rise of alternative energy solutions.

Renewable energy, including solar, wind, and even newer technologies like hydrogen fuel cells, has been a topic of discussion in India for a number of years. Despite their potential, the industry has not yet fully embraced these technologies because of issues with cost and scalability. We at Baudouin are fully prepared to incorporate this renewable technology into our products, yet cost is a crucial consideration. We are certain that we can provide more quickly than many of our rivals once the market determines they are cost-effective.

A major question regarding diesel engines is how long they will continue to be useful. India’s Planning Commission makes it evident that the government intends to spend more than INR 25 lakh crore on infrastructure. Reliable backup power is necessary for all these developments, including data centres, convention centres, metros, tunnels, and roadways. Currently, the most reliable option for crucial applications is still diesel generators. We want to be at the forefront of technology wherever we do business, ensuring that our goods are dependable and meet the needs of our clients.

Regarding infrastructure development, what are the main challenges facing the adoption of alternative power solutions in India?

The biggest hurdle is the acquisition cost. The cost of new technologies, whether it’s renewable energy or even the latest diesel engines meeting stringent emission norms, is significantly higher. India, in particular, is a standby market for power generation. Our generators often run for less than 100 hours a year, meaning they aren’t major contributors to pollution. However, as we shift towards more advanced emission standards like CPCB 4 Plus, we see a drastic reduction in particulate matter, thanks to better fuels and combustion technologies.

For example, Stage 5 emission norms, already applied in construction machinery and power generation, have led to significant improvements. The visible smoke from older engines is virtually eliminated, and particulate matter has been reduced by over 90 percent. So, while the technology exists and is effective, the challenge remains to make these solutions economically viable for widespread adoption.

You mentioned that India’s power generation capacity has improved, but there are still regions where power quality and availability are inconsistent. How do your solutions address these issues?

While India has made great strides in improving power generation and last-mile delivery, there are still pockets, especially in rural areas, where power quality and reliability are issues. The government is tackling this by promoting solar power in agricultural regions. States like Maharashtra provide farmers with free solar-powered submersible pumps, reducing the strain on the conventional power grid.

In rural areas, diesel generators are often seen as a luxury rather than a necessity. Our products are typically not needed in those regions because the government is working to provide alternative power solutions like solar. However, in urban infrastructure projects—metros, data centres, and commercial complexes—backup power remains critical, and that’s where our generators play an essential role.

You have recently launched new products and expanded your range. What markets are you targeting with these offerings?

We have taken two key steps with our latest product launch. First, we have exceeded the expectations for emission standards, particularly with our CPCB 4 Plus-compliant products. Second, we’ve expanded our range downwards. Previously, our products were available up to 250 kVA, but now we have introduced units as small as 62.5 kVA. This opens up a larger market for us, covering up to 20,000 units annually. However, the total market size is over 1,00,000 units, which fluctuates depending on demand from sectors like telecom, which is cyclical.

By expanding our product range, we’re increasing our market presence and aiming to capture a larger share of the DG set market. This will enhance our volumes, market share, and overall brand presence.

How does Baudouin’s product range complement the shift toward electrification?

The trend towards electrification in construction and infrastructure is undeniable. Some companies have already begun offering electric trucks and machinery. While we don’t directly play a role in electric vehicle manufacturing, our parent company, Shandong Heavy Industry, is heavily involved in equipment sales. We can offer electric-powered machinery through our parent company’s portfolio, but in India, we’ve decided to focus on the B2B market rather than B2C.

India’s B2C market for electric construction equipment is still in its nascent stage, and it’s challenging to enter. However, we’re closely monitoring the regulatory landscape as well. The government is pushing for better carbon emission regulations, and CPCB 4 Plus is a significant step in that direction. But with every new regulation, costs increase. For instance, Stage 5 emission norms have pushed up the equipment cost, but fortunately, the engine’s share of the total equipment cost remains relatively small—about 18-20 percent. So, while costs are rising, it’s not prohibitively expensive for customers.

You mentioned the cost implications of new regulations. How does Baudouin address these rising costs while ensuring value for customers?

The cost of meeting new emission standards has increased by around 30 percent, but it’s important to note that the engine cost only accounts for about 18-20 percent of the total equipment price. For example, if a piece of equipment originally cost ₹X, the increase due to new emission standards would be roughly ₹X + 7Y, where 7Y is the additional cost. This is far from a 30 percent hike on the equipment price, so customers still get good value.

However, from an ROI perspective, the situation is different for gensets. In India, due to the relatively low utilisation of generators, the return on investment (ROI) doesn’t always factor into purchase decisions. Customers’ priorities are meeting emission standards and ensuring fuel economy. Better fuel economy leads to lower emissions, as unburnt fuel contributes to inefficiency and higher emissions. We offer a clear advantage in this correlation between emissions and fuel economy.

Does Baudouin have a carbon neutrality or zero-carbon strategy in place?

We are actively working on a zero-carbon strategy, and sustainability is a core part of our plans. Our approach involves improving the fuel efficiency of our diesel engines and investing in alternative power solutions like hybrid and fully electric systems. We’re closely following market trends and regulatory changes to ensure we remain at the forefront of sustainable power solutions.

However, as I mentioned earlier, the key factor is affordability. While the technology exists, it needs to become economically viable for widespread adoption. Once that happens, we will be fully prepared to roll out sustainable solutions quickly and efficiently.

Looking ahead, what are Baudouin’s key objectives in the Indian market over the next few years?

Our primary objective is to become the technology leader in the power generation industry. We aim to expand our market share by offering a comprehensive range of products catering to various market segments, from smaller, more affordable generators to large, high-capacity units.

We are also focused on staying ahead of regulatory changes, particularly regarding emissions. CPCB 4 Plus is just the beginning, and we anticipate further tightening of emission norms in the coming years. Our goal is to be fully prepared for these changes and offer products that meet and exceed the requirements.

We want to maintain our commitment to sustainability by continuing to develop and refine our zero-carbon strategy. The future of power generation lies in a combination of diesel, hybrid, and fully electric systems, and we are positioning ourselves to be a leader in all three areas.

For more information, visit: https://baudouin.com/our-company/

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.