Indian Pump Industry: Meeting New Age Challenges

By Edit Team | October 4, 2019 12:35 pm SHARE

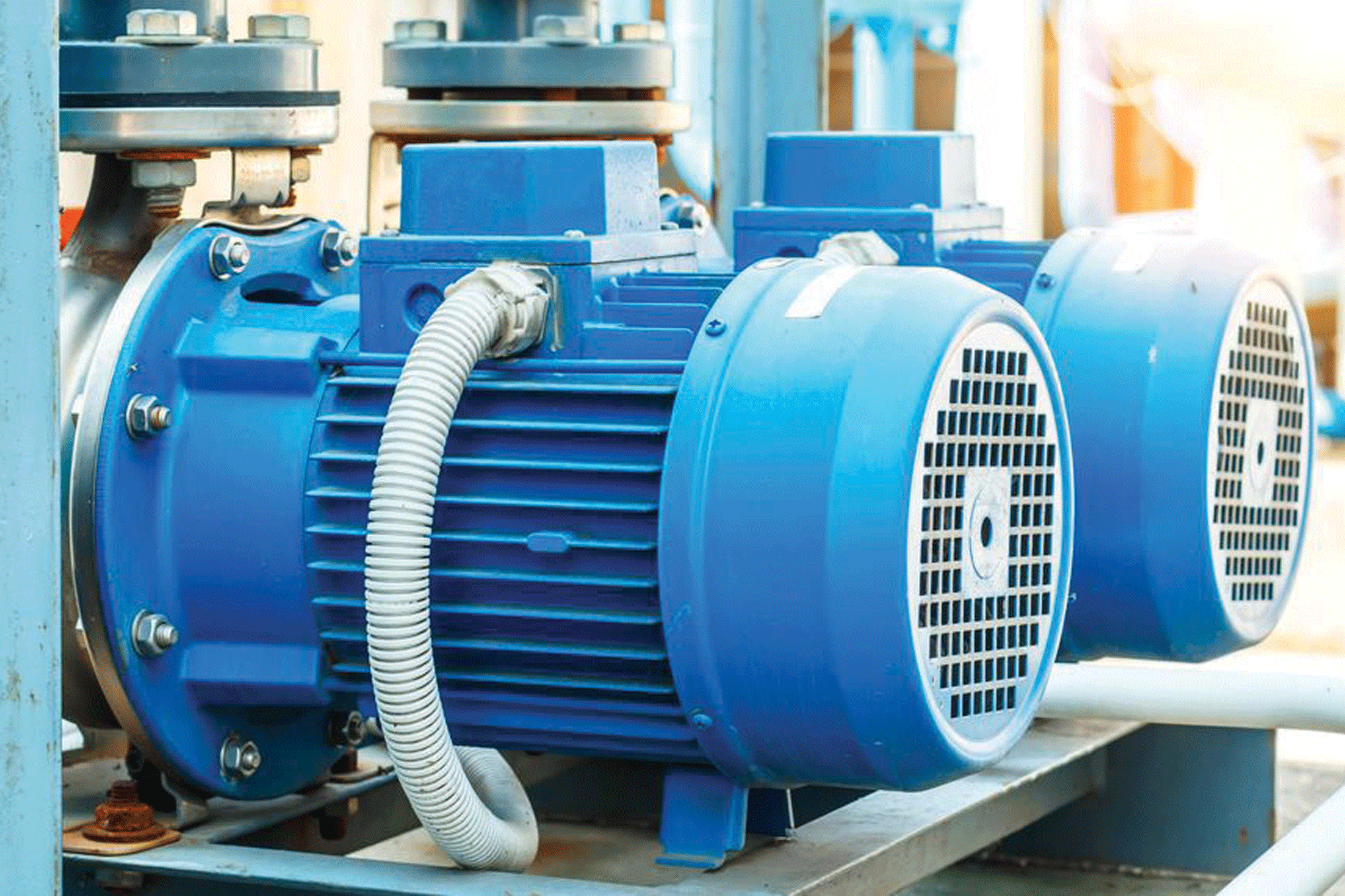

Water intensive industries are driving the growth of the pump industry and sustainability is one of the major concerns

The Indian pump industry plays a vital role in almost every sphere including infrastructure and agriculture contributes significantly to the growth of Indian economy. Rapid depletion of groundwater and rapid urbanisation are contributing to the exponential growth of water pumps market in India. The water pump market in India is likely to surpass $3.8 billion by 2022, according to India Water Pumps. As the country moves towards urbanisation, energy efficiency continues be of importance. Solutions including intelligent water and wastewater management will witness increased demand, owing to initiatives like smart cities etc.

Market trends and requirements

Pumps consume approximately 10 per cent of the world’s total electricity, mostly because most of them run inefficiently and therefore it is important to opt for energy efficient pumps. Consumers have started understanding the importance of lifecycle costs of pumps, since the purchase price makes up only 5 per cent of the costs with an estimated lifetime of 10 years for the pumps and the energy costs account for a huge 85 per cent of the pump’s lifecycle costs. Shifting to energy efficient solutions can generate significant savings and aid in reduction of global energy consumption, according to Saravanan Panneer Selvam, General Manager, Grundfos India.

“Industries and corporates across domains are also becoming increasingly conscious about the environmental impact of their operations therefore they are moving towards solutions that improve the efficiency of pumping systems to reduce greenhouse gas emissions.” he adds.When we talk of valves for water line/plumbing/firefighting/HVAC and generic industrial applications we see that there is a huge unorganised sector that is in the marketplace to offer stiff competition to the organised sector. The survival of this intermediate industry is dependent on the growth of core sector in Indian economy.

With the imposition of new reforms, RERA directives etc the construction and infrastructure industry is experiencing a slowdown . Under such circumstances the efficiency of this unorganised sector is drifted to offering attractive discounts to ensure their share. Inevitably this price cutting has proportional effect on the quality of the product. Conversely the organised sector takes a hit and the margin of profits diminsh. And this is what is happening in the current scenario, informs Rakesh Kumar, Vice President (Business development), Zoloto Industries.

Indian Industries Vs rest of the world

“The Indian valves manufacturing companies are facing increasing competition from outside India specifically from China. India as manufacturing hub for MNCs large multinationals are now looking at India as manufacturing base because of large pool of technically qualified people, low manufacturing cost and english-speakingpopulation. The companies also recognise India’s capability of manufacturing quality valves,” states Kumar.

The Indian pump industry has been growing at an annual CAGR of 10 per cent, while the international CAGR is approximately 6 per cent. The growth is attributed to the rise in infrastructure development, growth in agriculture and other water intensive industries. The Indian pump industry is fragmented with a large number of unorganised players. “Quality control is difficult to execute in the unorganised markets. Therefore, we find it challenging to increase adoption of good quality and efficient pumps that results in energy savings and provide sustainable solutions. Our efforts are centred around driving awareness on product life cycle costs to gain better results in the long run as against focusing on short term gains by opting for low cost pumps,” says Selvam.*

*References: https://www.techsciresearch.com/news/318-india-water-pumps-market-to-grow-at-around-12-till-2020.html

Shifting to energy efficient solutions can generate significant savings and aid in reduction of global energy consumption.

Saravanan Panneer Selvam, General Manager, Grundfos India

India as manufacturing hub for MNCs large multinationals are now looking at India as manufacturing base because of large pool of technically qualified people, low manufacturing cost and english-speaking population.

Rakesh Kumar, Vice President (Business development), Zoloto Industries

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

-20240213125207.png)