Downstream Aluminium: Meeting the EV demand through innovation in production

By Edit Team | May 31, 2021 7:19 pm SHARE

Policy incentives and technological advancements are going to guide the manufacturing and adoption of EVs or Electric Vehicles in a big way, as India witnesses a sea-change in its attitude towards the segment.

Electrified and efficient are words often used to describe the future of the automotive sector, which is also set to push the demand for aluminium exponentially, with innovation in products being the focus of the downstream aluminium sector.

A bright spot

EVs are a bright spot in the Indian automotive segment as they are a key element of the transition to cleaner energy. Government of India data released earlier in Parliament has a promising story to tell. India saw 69,012 units of electric vehicles being sold in 2017-18.

These numbers went up to 1,43,358 units in 2018-19 and to 1,67,041 units in 2019-20. The growth in units includes sales of two-wheelers, three-wheelers, and buses. Two-wheelers have led this growth. With the government having its eyes set on selling only electric cars in India after 2030, the sector is poised for the biggest renewable energy revolution the country has seen.

Making it drive

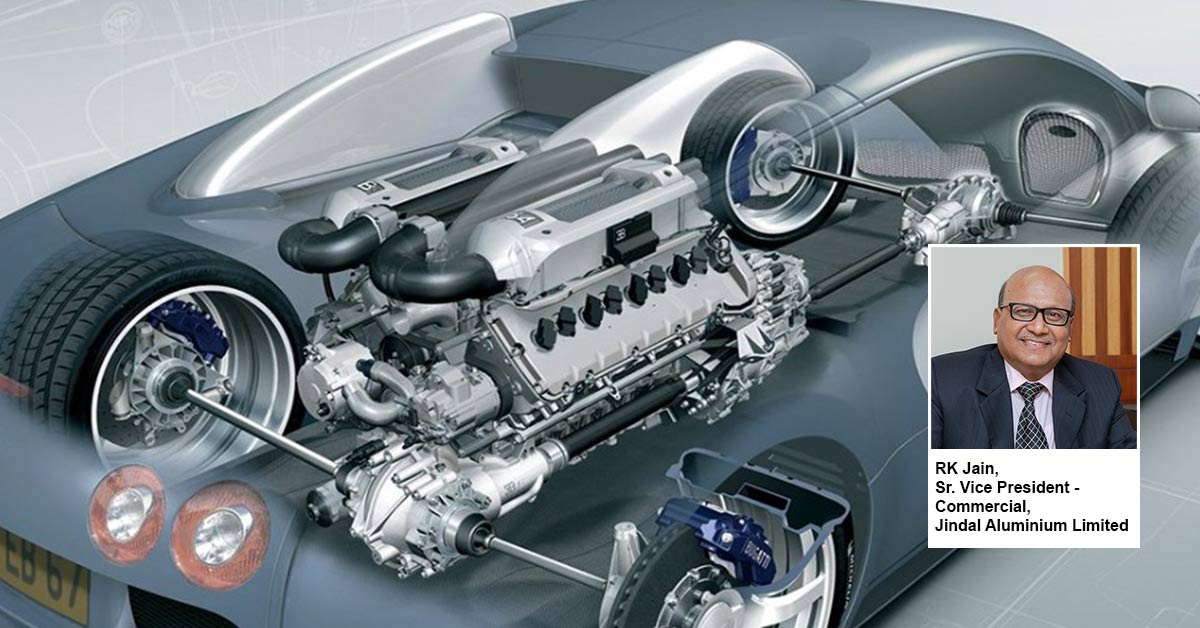

Making the EV story successful is aluminium, both used in the manufacturing of electric vehicles and also in creating the necessary charging infrastructure. A higher performance metal, the push for EVs is adding importance to the role that this light and sturdy metal will play as it brightens prospects for the downstream aluminium segment as a whole.

From the challenge of helping vehicle manufacturers in reducing vehicle weight to improving the efficiency of conventional vehicles or to better the range of electric vehicles, aluminium extrusions are an increasing part of the solution.

Customisation in production

The shift to electric vehicles is no longer just an option; it is a must. India, China, many European countries, and the United States have all already decided in favour of electro-mobility supported by R&D programs, charging infrastructure, and buyer incentives.

This is an opportune moment for the downstream aluminium sector – which is an old partner of the automobile industry and finds its use in the making of a vehicle body, doors, trunks, hoods, bumpers, crash boxes, brakes, cables, wheels, etc. – to increase its overall usage.

However, bringing about innovation in production is the need of the hour for the Indian downstream aluminium manufacturers if we want to meet the EV demand. Innovation in production is also crucial to raise the average quantity of aluminium used per vehicle from India’s average of 29 kg per vehicle to global usage standards of 160 kg or 250 kg as predicted for use in EVs in time to come.

Automobiles, whose bodies are made of aluminium are costlier than their other metal counterparts. This poses as one of the major obstacles to Aluminium’s market appeal in India. This will be addressed once the demand for EVs picks up and costs are lowered.

As consumers get environmentally conscious and government introduces policies that require vehicles to bring out variants that are to be more fuel-efficient than before, fuel-saving, carbon emission, costs, including repair are areas where the downstream aluminium sector has an important role to play.

Innovation is needed and is already being done at various levels. For instance, in meeting the EV demand, the automobile industry is looking at major changes in vehicle manufacturing that will focus on improved combustion, calibration, injection, and cylinder pressure. Downstream aluminium suppliers are meeting the needs through extrusions and rolling by using technology and innovation.

New applications of downstream aluminium include lightweight battery casings and heat exchangers, besides overall structural integration. Offering a higher strength-to-weight ratio compared to other metals, the ability to absorb a larger amount of crash energy, and ensuring that vehicular performance enhancements do not come at the cost of safety is what downstream aluminium offers to the automobile industry, especially in meeting the EV demand.

All this, and the ease with which aluminium fits into creating simple and intricate shapes giving an elegant finish to the vehicle, make it an automaker’s dream metal. Thus, not only will this innovation in material supplied lead to light-weighting, lowering costs, and meeting the commitments of going green, it will, through EVs, now offer a higher per-unit usage of downstream aluminium products in automobiles.

For more details, contact:

RK Jain,

Sr. Vice President – Commercial,

Jindal Aluminium Limited

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

-20240213125207.png)