Infrastructure development pushing steel bar market growth

By Edit Team | September 11, 2021 10:24 am SHARE

Continuing construction activities in infrastructure and real estate segments in spite of the pandemic impact are going to push the growth of steel bar market.

India is consolidating its position as the most important market for steel in the global market as the country stood second in steel production globally. In FY21, the production of crude steel and finished steel stood a 102.49 million tonne (MT) and 94.66 MT, respectively. A CARE Ratings market outlook indicates that the crude steel production to reach 112-114 MT, an increase of 8-9 percent year-on-year (YoY) in FY22.

Demand drivers

Traditionally, steel has been in use across various segments, however, the major demand drivers now are infrastructure, oil and gas, and automotive industry. In April 2021, India’s finished steel consumption stood at 6.78 MT, while export rose by 121.6 percent YoY, compared with 2020. In 2021, Indian Railways is planning to procure over 11 lakh tons of steel from Steel Authority of India Limited (SAIL) for the track renewal and laying new lines across the country.

Policy push

Government has taken various steps to boost the sector including the introduction of National Steel Policy 2017 and allowing 100 percent Foreign Direct Investment (FDI) in the steel sector under the automatic route. The policy aims to increase the per capita steel consumption to 160 kg by 2030-31.

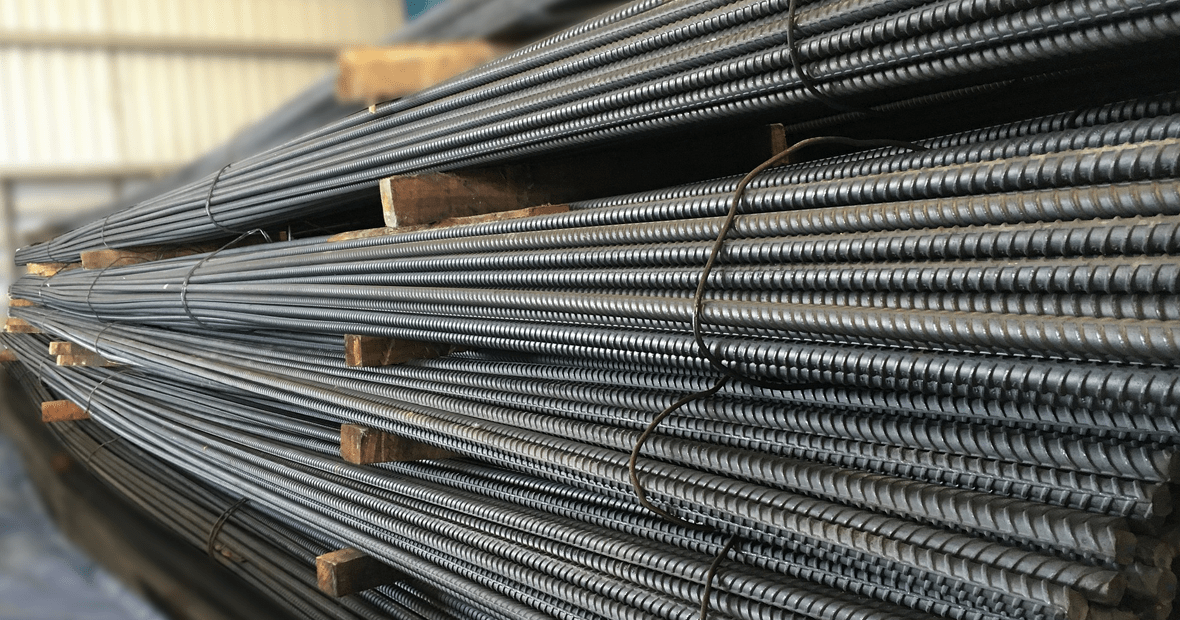

Steel rebars market trends

The key demand for steel rebar is from infrastructure, and the segment will grow at a substantial CAGR of 6.2 percent globally during 2021-26, according to an Industry Arc report. According to the World Bank, the infrastructure investment gap attributable to roads only is estimated to be $8 trillion. In coming years, there will be augmented road development across the world, and steel rebar is commonplace in road development projects as it is used to reinforce concrete. Increasing infrastructural development will create lucrative prospects for the steel rebar market.

In India, the construction market is growing leaps and bounds in the past few years. In spite of the ongoing pandemic-induced market uncertainties, various construction projects, especially the largescale infrastructure projects are going on at a steady rate. In the next two years, the construction market in the country is expected to bounce back and cross the pre-Covid era market statistics.

While the government is focusing on constructing multiple number of expressways across the country, unique mega projects like the High-speed Rail Corridor Project (bullet train project) are underway in the country. These kinds of projects are pushing the boundaries of steel in India towards substantial growth.

According to Sunil Kumar Agarwal, Director, Kamdhenu Ltd, the key segment driving demand for steel bars is the construction sector. “Real estate developers as well as individual buyers in urban and rural areas also use steel bars for home construction purposes. Other infrastructure projects such as bridges and highways also consume steel bars and contribute to the demand for steel,” he adds.

Advantage steel bars

Significant growth in the construction industry over the years is one of the key factors creating a positive outlook for the market, according to an Industry Arc report. Furthermore, extensive infrastructural development, especially in developing countries, is stimulating the market growth. Steel rebars are widely used in the construction of modern skyscrapers, roads, highways, bridges, sewage tunnels, airports and stadiums. In line with this, growing requirements for deformed steel reinforcing is contributing to the market growth. It is used as a prestressed reinforcing bar in construction activities for minimal slippage and improved bonding with the cement beams and columns. Additionally, various product innovations, such as the development of TMT that aids in improving the quality of rebars, are acting as other growth-inducing factors. This enables product manufacturers to create variants with superior tensile strength, ductility and corrosion resistance. Other factors, including rapid industrialization, along with growing product demand from the non-residential sectors, such as oil and gas and manufacturing, are anticipated to drive the market further.

Design innovations

Today’s consumers of steel are looking for the best quality steel bars with value-added properties such as corrosion-resistant steel bars, epoxy-coated, earthquake-resistant and galvanised rebars. TMT bars are the most preferred in construction of buildings and infrastructure projects as they are high strength and ductile compared to its predecessors. Round, square-twisted, ribbed, stretched and ribbed-twisted are some of the commonly used steel rebars. They are used as a reinforcement to provide support to the structural designs, for minimising cracking and temperature-induced stress and supporting other steel bars for equal distribution of the overall load. They offer various advantages, such as high durability, tensile strength, thermal resistance and malleability.

“Modern construction requires high performance TMT bars that are earthquake-resistant and have high thermal resistance as well,” Sunil Kumar highlights. Kamdhenu incorporated the latest TMT technology and world-class manufacturing process using high grade pure FE500 & 500D, according to Sunil Kumar.

Market outlook

According to the World Steel Association (WSA) forecast, India’s steel demand is expected to rebound by 19.8 percent in 2021, the highest rate among the top-10 consuming nations.

The National Steel Policy 2017 aims to increase the per capita steel consumption to 160 kg by 2030-31. Steel companies plan to invest ~`60,000 crore (US$ 8.09 billion) over the next three years. The Union Budget 2021-22 has a 34.5 percent YoY increase in allocation for capex at `5.54 lakh crore (US$ 74.60 billion). The budget’s focus is on creating infrastructure and manufacturing to propel the economy. The enhanced outlays for key sectors including the infrastructure construction would catalyse the growth of steel consumption in future. “The governments push on infrastructure in various sectors will boost the demand for steel bars in the long run,” Sunil Kumar.

The various government schemes such as the National Infrastructure Pipeline, Housing for All, Smart Cities, etc are expected to push the growth of steel market in India, especially the steel bar market. However, the growing steel prices across all the categories is a cause of concern for consumers from these segments. This cost increase is affecting the overall project cost in construction and infrastructure. As the pandemic is still not over, there may be some uncertainty in the market though not as severe as last year. In spite of all these, the overall market looks bright for the steel industry in India for the coming years.

Cookie Consent

We use cookies to personalize your experience. By continuing to visit this website you agree to our Terms & Conditions, Privacy Policy and Cookie Policy.

-20240213125207.png)